- Izba Ecosystem Newsletter

- Posts

- Navigating State Sales Tax Nexus: Five Tips You Should Know

Navigating State Sales Tax Nexus: Five Tips You Should Know

Cold Chain Challenges in Meal Kits

Sales tax nexus may seem like a complicated topic. Ultimately, it all comes down to whether or not your company has made enough sales or business in a state to owe sales tax there. The most important thing is understanding how to stay in compliance with tax laws in order to avoid potential tax penalties.

In this article, we’ll explain everything you need to know about navigating the state sales tax nexus.

Sales Tax Nexus Overview

Nexus refers to a connection or series of connections between two things. In the US, sales tax nexus means that a retailer has a connection with a state that requires them to collect sales tax from buyers there.

This could be as obvious as operating your store or having business headquarters in the state. Or it could be less obvious, like shipping orders to specific states and triggering economic nexus because you, as a seller, exceeded the economic nexus sales tax threshold set by that state.

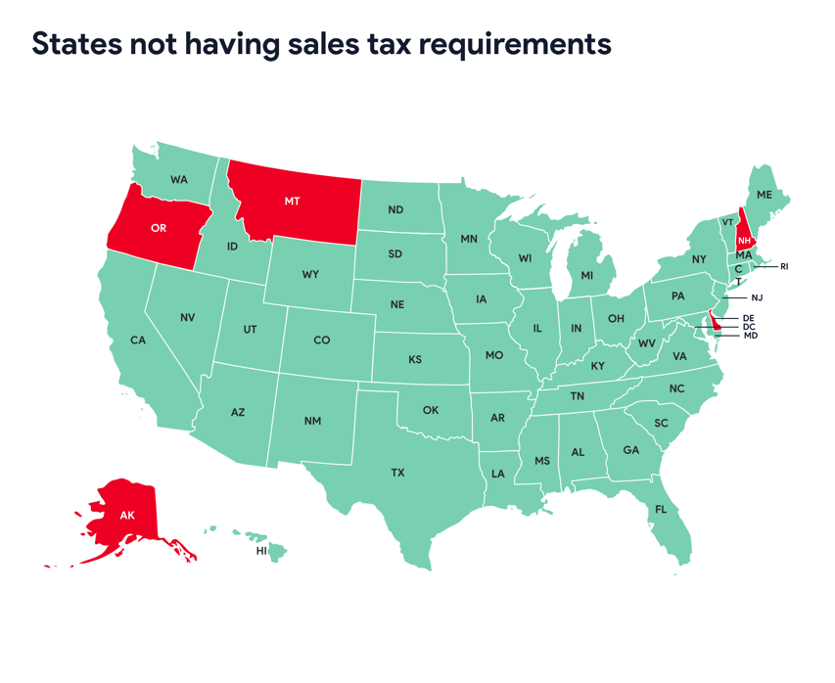

Businesses that have nexus in a state must collect sales tax. The only states that do not require companies to charge and remit state sales tax are Alaska, Delaware, Montana, New Hampshire, and Oregon.

Understanding the Types of Sales Tax Nexus

There are different types of state sales tax nexus that can be triggered. These include:

Physical nexus: This one is pretty straightforward. If you have offices, warehouses, or even employees in a state, you’ve got nexus.

Economic nexus: If you hit a certain amount of sales or transactions in a state, you will likely hit nexus. It doesn’t matter if you’ve never been in the state before.

Affiliate nexus: If you have partners or affiliates in a state who promote your products or services, it may pull you into nexus territory.

Click-through nexus: This occurs when someone clicks on a website link, which leads them to your goods or services. If enough clicks turn into sales, you’ll likely have nexus.

Marketplace nexus: Do you sell on platforms like Amazon or Etsy? Using a marketplace can cause you to meet nexus thresholds based on their ties to various states.

Common Nexus Scenarios

Several nexus scenarios may apply if you’re responsible for supply chain management across multiple states. You may trigger nexus for your business if you have:

Warehouses and fulfillment centers: Businesses with inventory or operational facilities in different states can create nexus. It’s all based on your location and whether you have employees in that state.

Sales and transactions: If you have a significant number of transactions or business activities in a state or across states, you’ll likely have nexus. Typically, most states have a 200-transaction or $100,000 sales limit to qualify for nexus, which includes collecting and remitting sales tax to the states.

Sales representatives: If you have any sales personnel or agents who are operating across states, you can expect to have nexus there. For example, if you have agents selling in California and Nebraska, you’ll have a physical presence in both states.

Tips for Managing State Sales Tax Nexus

Staying compliant in the state where you operate is crucial for any business. If you don’t stay in compliance, you’ll likely be hit with a failure to file and a failure to pay penalty, depending on the state to which you owe sales taxes.

Here are some things you can do to manage state sales tax nexus and stay in compliance.

1. Conduct a Comprehensive Nexus Analysis

First things first, monitoring and documenting the states where you have nexus is essential. It’s like keeping a diary of all business relationships and transactions that could affect your tax obligations.

You’ll want to regularly assess and conduct a comprehensive analysis of where your company does business based on its physical presence, economic activities, and inventory.

2. Utilize Sales Tax Automation Tools

Tracking sales tax and nexus thresholds doesn’t have to be done manually. Thankfully, there are tools out there that can help. Sales tax automation tools, like sales tax software, can help streamline the process and reduce the risk of errors. These tools automate the calculation and reporting of sales tax.

In addition, with sales tax automation, you can stay current on the latest tax rates and rules, generate accurate rates for tax authorities, and alleviate many other challenges that come with running an online business.

3. Stay Informed About State-Specific Sale Tax Laws

Just like each state has its own state bird and motto, they also have their own rules around nexus and nexus thresholds. Each state has different sales tax rates that businesses must charge to customers once they hit the nexus threshold. As mentioned above, the nexus threshold is generally a 200 transaction limit or $100,000 in sales, depending on the state.

If you don’t keep up with changing laws and regulations, you may not be charging the right sales tax rate to your customers. You can use sales tax automation software or subscribe to each state’s Department of Revenue where you operate to keep up to date.

4. Consult with Tax Professionals

If you need help figuring out where to start with sales tax nexus, consider speaking with a tax professional. A sales tax expert can help guide you in the right direction regarding what states you need to file sales tax returns and how often so you can ensure you stay compliant.

5. Develop a Nexus Management Strategy

The final step to managing nexus is monitoring and developing a strategy that works well for your company. This would include how often you should look into state tax laws and rate changes and ensure you haven’t crossed any nexus thresholds in new states.

If you don’t want to handle nexus tracking manually, an automated sales tax solution likeZamp can help keep your business on track.

State Sales Tax Nexus: The Bottom Line

Understanding how state sales tax nexus works is vital for companies that want to stay compliant and avoid hefty penalties. The good news is that you don’t have to handle sales tax alone. Izba Consulting specializes in driving profitability and enhancing supply chain operations, which are critical to scaling your business.

In addition, a managed sales tax solution, like Zamp, can help you stay compliant from start to finish. They offer a full sales tax compliance service, where a dedicated and experienced customer service team handles the setup process and configures your account. After that, they handle all things sales tax, from nexus tracking to registration, mapping, reporting, and filing.

Get in touch with Zamp for a free nexus assessment and answers to your sales tax questions.

Like what You See?

Which state has the highest sales tax? |

In this state, residents may face a sales tax rate of up to 9.56%

What We’re Reading

Walmart to Offer Logistics Outside Its Own Marketplace Sales: Walmart is expanding its logistics services to include companies that do not sell on its marketplace. This move allows Walmart to leverage its supply chain infrastructure to compete more directly with Amazon by offering end-to-end fulfillment and delivery services for third-party sellers outside of its platform. (WSJ)

USPS proposes changes to save $3 billion per year, starting in 2025: The U.S. Postal Service is proposing changes aimed at saving $3 billion annually by streamlining its regional networks while maintaining local mail delivery times of one to three days. These changes, which will not affect election mail or holiday shipments, focus on adjusting delivery times and better utilizing ground networks to improve efficiency and ensure long-term viability amid declining first-class mail volumes and increasing package deliveries. (AP News)

Why China Is Building Its First Megaport in Peru: China is constructing its first megaport in Peru, a major infrastructure project that aims to enhance trade routes between Asia and South America. The port, located in Chancay, will provide China with a strategic foothold in the Pacific, allowing for more efficient shipping of goods and materials. This development reflects China's broader ambitions to expand its influence in Latin America, leveraging the port to strengthen economic ties and gain greater access to key resources. (WSJ)

5 Predictions for the 2024 Holiday Shopping Season: The 2024 holiday shopping season is expected to see significant trends, including an increase in early shopping due to inflation concerns, a rise in mobile commerce, and a focus on sustainability with consumers seeking eco-friendly products. Retailers are likely to enhance personalization in their marketing efforts and offer more flexible payment options to attract budget-conscious shoppers. These predictions suggest that retailers should prepare for a competitive season with a focus on technology and consumer preferences. (Practical Ecommerce)

UPS plans surge fee for all China-to-US imports: UPS has implemented a new surcharge on U.S. imports from China due to increased costs related to managing the surge in demand and supply chain disruptions. The surcharge is part of a broader strategy to manage capacity and maintain service levels as global shipping challenges continue to impact logistics. This fee highlights ongoing difficulties in the supply chain and the costs associated with importing goods from China. (Supply Chain Dive)

Ecommerce On Tap

On the latest episode of "Ecommerce On Tap," hosted by Nathan Resnick and Aaron Alpeter, we dive deep into the transformation and challenges of meal kit companies like Sunbasket. Here's what you need to know:

💡 Three Key Takeaways:

Strategic Shifts & Mergers:

Sunbasket merged with keto-focused Pruvit in 2021 to form Intelligent Foods and further acquired Gobble. This consolidation strategy led to a profitable turnaround by 2022.

Operational Excellence:

By leveraging predictive algorithms and robust supply chain practices, Sunbasket has minimized errors in fulfillment and last-mile delivery, achieving only 50-70 mistakes per 100,000 weekly meals while covering 98% of US zip codes.

Challenges & Innovations in Cold Chain Delivery:

The importance of maintaining food safety and freshness in cold storage delivery is highlighted, especially amidst shipping variability. Companies must innovate with packaging and insulation to ensure products arrive safely within the critical temperature threshold of 40°F.

Looking for unbiased, fact-based news? Join 1440 today.

Upgrade your news intake with 1440! Dive into a daily newsletter trusted by millions for its comprehensive, 5-minute snapshot of the world's happenings. We navigate through over 100 sources to bring you fact-based news on politics, business, and culture—minus the bias and absolutely free.